Exploring Options: Can Former Bankrupts Secure Credit Score Cards Adhering To Discharge?

One usual question that arises is whether former bankrupts can efficiently get credit rating cards after their discharge. The answer to this inquiry involves a diverse expedition of different aspects, from debt card options customized to this group to the impact of past financial decisions on future credit reliability.

Recognizing Bank Card Options

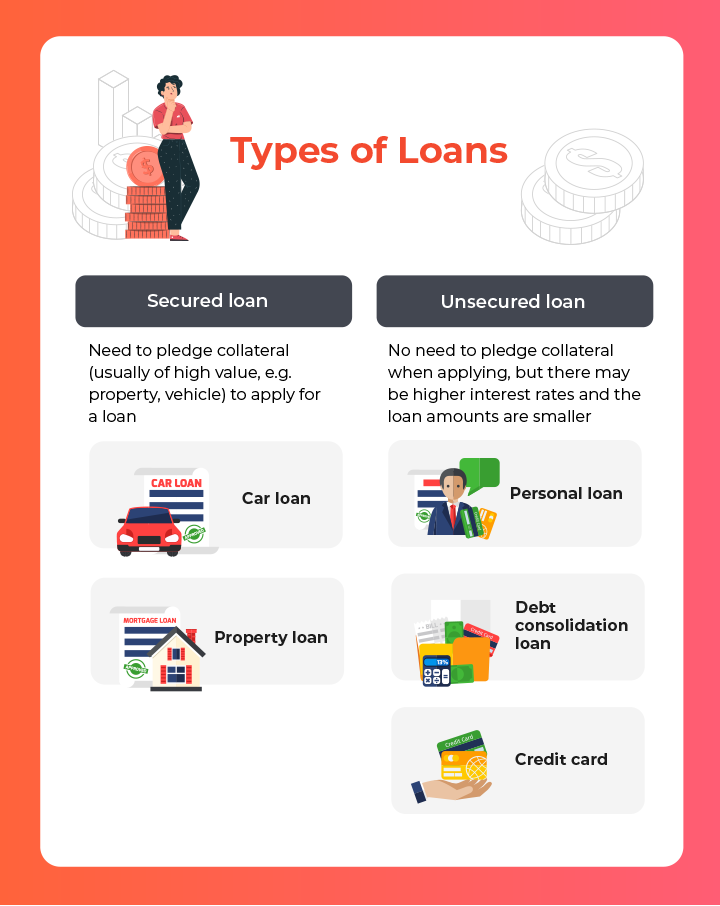

When considering credit cards post-bankruptcy, people must meticulously evaluate their demands and financial circumstance to pick the most suitable alternative. Safe credit rating cards, for circumstances, call for a cash deposit as security, making them a viable selection for those looking to rebuild their credit score background.

Furthermore, individuals should pay close focus to the yearly percent rate (APR), poise duration, annual charges, and incentives programs offered by various debt cards. By adequately evaluating these variables, individuals can make educated choices when choosing a credit history card that aligns with their financial objectives and scenarios.

Variables Influencing Approval

When requesting charge card post-bankruptcy, recognizing the variables that impact approval is necessary for individuals seeking to restore their monetary standing. One important variable is the applicant's credit report. Complying with a bankruptcy, credit report ratings typically take a hit, making it harder to get approved for typical charge card. However, some companies offer protected charge card that need a deposit, which can be a more attainable option post-bankruptcy. One more considerable element is the applicant's earnings and employment standing. Lenders wish to make certain that individuals have a stable income to make timely repayments. In addition, the length of time considering that the personal bankruptcy discharge contributes in approval. The longer the period because the personal bankruptcy, the greater the possibilities of approval. Demonstrating accountable monetary habits post-bankruptcy, such as paying costs in a timely manner and keeping credit usage reduced, can likewise positively influence bank card approval. Recognizing these aspects and taking steps to enhance them can enhance the chance of safeguarding a bank card post-bankruptcy.

Protected Vs. Unsecured Cards

Secured debt cards require a money deposit as security, generally equivalent to the credit limit prolonged by the issuer. These cards normally offer higher credit report restrictions and reduced passion prices for people with good credit score ratings. Inevitably, the choice in between secured and unsecured credit scores cards depends on the individual's financial situation and debt objectives.

Structure Credit Scores Properly

To properly reconstruct credit report post-bankruptcy, establishing a pattern of responsible credit rating utilization is crucial. Furthermore, keeping credit rating card equilibriums low relative to the credit restriction can positively influence credit browse around here score scores.

An additional method for building debt properly is to monitor credit records routinely. By evaluating credit scores records for mistakes or signs of identification theft, individuals can address concerns without delay and preserve the precision of their debt history. Additionally, it is advisable to avoid opening up multiple new accounts at the same time, as this can signal economic instability to potential loan providers. Rather, emphasis on gradually branching out charge account and showing regular, liable credit history actions over time. By complying with these methods, people can progressively rebuild their credit history post-bankruptcy and job in the direction of a much healthier financial future.

Gaining Long-Term Conveniences

Having established a foundation of liable credit rating management post-bankruptcy, people can now focus visit this web-site on leveraging their boosted credit reliability for lasting monetary benefits. By consistently making on-time settlements, keeping credit history utilization reduced, and monitoring their credit rating records for accuracy, previous bankrupts can slowly reconstruct their credit rating ratings. As their credit history raise, they may come to be eligible for far better credit report card offers with reduced rates of interest and higher credit score limitations.

Enjoying long-lasting advantages from boosted credit reliability expands past simply credit scores cards. Furthermore, a positive credit report account can boost work leads, as some companies might check credit report records as part of the employing process.

Conclusion

Finally, former insolvent individuals may have problem safeguarding credit history cards adhering to discharge, yet there are options available to help reconstruct credit score. Understanding the different sorts of credit history cards, variables impacting approval, and the importance of responsible charge card sites use can assist people in this circumstance. By selecting the ideal card and utilizing it properly, former bankrupts can slowly improve their credit history rating and enjoy the long-lasting benefits of having access to credit rating.

Demonstrating responsible economic actions post-bankruptcy, such as paying costs on time and maintaining credit report use low, can likewise favorably affect credit history card approval. Additionally, keeping credit history card equilibriums reduced family member to the credit score limitation can positively affect credit scores. By consistently making on-time repayments, maintaining credit score use low, and checking their credit score reports for accuracy, former bankrupts can progressively reconstruct their credit history scores. As their credit score scores raise, they may come to be eligible for far better credit score card provides with reduced rate of interest prices and higher credit rating restrictions.

Understanding the various kinds of credit score cards, elements influencing approval, and the value of liable credit report card use can aid people in this circumstance. secured credit card singapore.